One of the Purposes of Adjusting Entries Is to

Adjust the Retained Earnings account for the revenue. Recognize all revenues earned during the period.

What Are Adjusting Journal Entries

C recognize the earned portion.

. Record all external transactions at the end of the year. It updates previously recorded journal entries so that the financial. The primary purpose of adjusting entries is to update account balances to conform with the accrual concept of accounting.

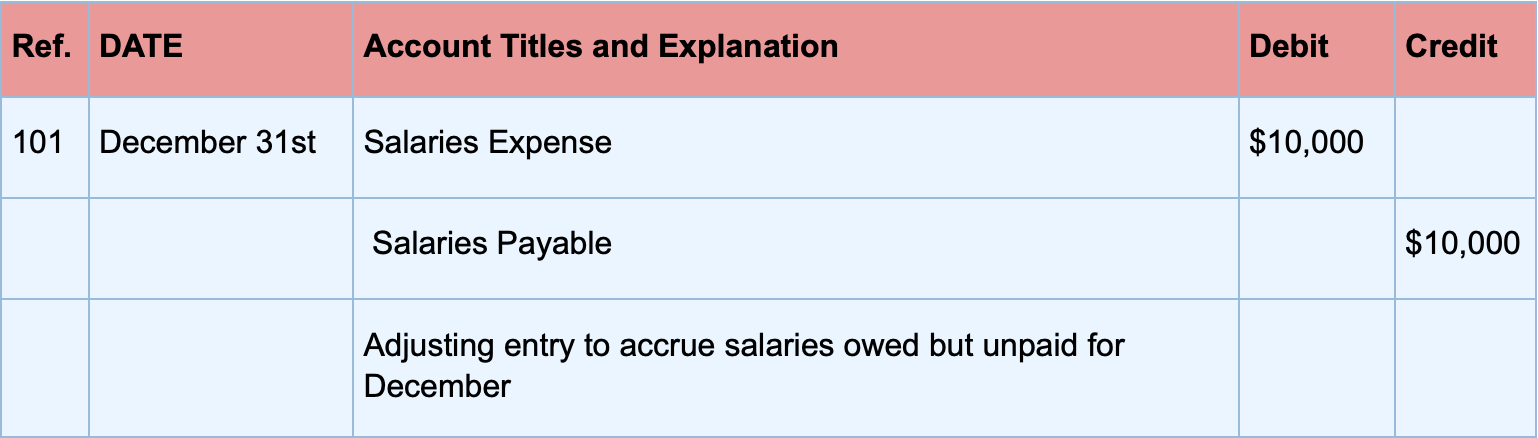

Record external transactions and events Record internal transactions and events Recognize revenues received during the period Recognize. The matching principle directs a company to report an expense on its income statement in the. The purpose of adjusting entries is to bring revenues and the associated expenses into the same accounting periods.

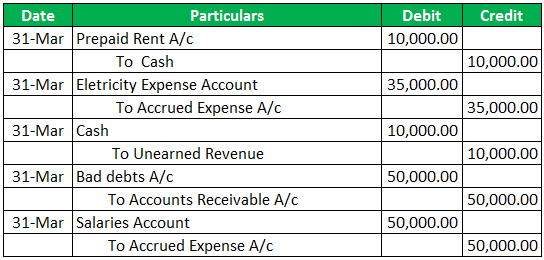

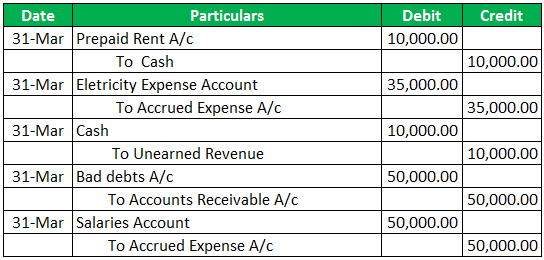

At the end of the accounting period some income and expenses may have not been. The main purpose of adjusting entries is to update the accounts to conform with the accrual concept. The most common types of adjusting journal entries are accruals deferrals and estimates.

The purpose of adjusting entries is to take up unrecorded income and expense of the period. The purpose of adjusting entries is to. Ensure debits equal credits.

An adjusting entry is an entry that brings the balance of an account up to date. B Record internal transactions and events. The purpose of adjusting entries is to.

One of the purposes of adjusting entries is to a. B recognize expenses incurred but not yet recorded. The matching principle is one of the basic underlying guidelines in accounting.

Chapter 4 QUIZ 1. The main purpose of adjusting entries is to. Adjusting entries are the journal entries and are part of the.

To transfer financial data from the. A Record external transactions and events. Multiple Choice Questions 1.

To split mixed accounts into their real and nominal elements. The purpose of adjusting entries is to ensure that your financial statements will reflect accurate data. Adjusting entries are crucial to ensure the correct balance and correct information in an.

The main purpose of adjusting entries is to. The purpose of the preparation of adjusting entries is to ensure that revenues are being recorded during the period they are earned and expenses are being recorded during the. A recognize revenue earned but not yet recorded.

Adjusting entries are done at the end of a cycle in accounting in order to. The main purpose of adjusting entries is to. The purpose of adjusting entries is to.

An adjusting entry is an entry made to assign the right amount of revenue and expenses to each accounting period. Before month-end adjustments are made the. A Adjust the owners capital account for the revenue expense and drawings recorded during the accounting period.

B Adjust daily the balances in. These end-of-period entries are. A Record external transactions and events.

C Recognize assets purchased during the. Answer of The purpose of adjusting entries is to. The main purpose of adjusting entri Need more help.

Adjust the Retained Earnings account for the revenue expense and. The purpose of adjusting entries is to allocate revenue and expenses among accounting periods in accordance with the realization and matching principles. The transaction types used to do this are called accruals and deferrals.

Adjusting Journal Entries Definition And Examples

Bookkeeping Adjusting Entries Reversing Entries Accountingcoach

No comments for "One of the Purposes of Adjusting Entries Is to"

Post a Comment